Did you know that Series A funding typically ranges from $2 million to $15 million? As of early 2024, this amount has increased to an average of $18.7 million. Understanding the various stages of startup funding is essential for any entrepreneur, especially when seeking funds for growth. These stages vary from the initial pre-seed stage to the more advanced Series C rounds, each playing a crucial role in securing capital and advancing your business.

Understanding the importance and setup of each funding stage is crucial. It helps you plan how to raise money. You need to know what these rounds mean, including where the money might come from, how much you might get, and who wants to invest. This is very important for your startup’s journey to success.

Key Takeaways

- Series A funding usually exceeds $10 million and is pivotal for launching startups.

- Pre-seed funding marks the initial investment phase, primarily from friends and family.

- Seed funding participants often include angel investors and accelerators.

- Series B funding focuses on expanding market presence and raises tens of millions.

- Series C funding is geared towards scaling operations, with valuations often over $100 million.

- The average funding size and company valuations vary significantly across stages.

Understanding Startup Funding Rounds

Startup funding rounds are key stages where a startup gets money for growth and operations. Each stage is a step in the startup journey, attracting different investors. A funding rounds overview will show you the usual sizes and expectations at each phase, shaping your startup finance strategy.

In the earliest stage, known as pre-seed, startups might get about $50,000. By the seed phase, funding can reach around $1 million. This sets the stage for the next phases. When moving to Series A, the amount can jump to $3 million due to growing investor confidence. Series B funding often hits around $10 million. Series C funding can skyrocket to $20 million.

For startups aiming at higher growth, Series D, E, and F rounds can offer even more—usually $50 million and $100 million. An IPO, the peak achievement, might average about $250 million.

When deciding to invest, factors like how mature your startup is, the market situation, and financial forecasts matter a lot. Understanding these aspects is key to effectively moving through the entrepreneurial financing journey.

| Funding Round | Average Size |

|---|---|

| Pre-Seed | $50,000 |

| Seed | $1 million |

| Series A | $3 million |

| Series B | $10 million |

| Series C | $20 million |

| Series D | $50 million |

| Series E & F | $100 million |

| IPO | $250 million |

What Are Startup Funding Rounds?

Getting to know how startup funding rounds work is key for entrepreneurs. These rounds are when a startup gets money from investors and gives them a share of the company. They follow a set pattern that matches the company’s growth stages. It’s vital for entrepreneurs to understand this structure. It shows them how crucial funding is for growing their business.

Definition and Importance

Funding is crucial because it gives a startup what it needs to succeed. It helps startups grow, bringing new ideas and better operations to life. As companies grow, they go through different stages to get the right investment. Each round of funding is important. It helps them evolve from a mere idea to selling actual products.

Typical Structure of Funding Rounds

Funding rounds have a structure that matches where the startup is:

- Pre-Seed: The first money usually comes from personal savings or help from family and friends.

- Seed: Investments here can be from $250,000 to $1.5 million, often from angel investors or crowdfunding.

- Series A: At this point, companies might be worth $2 to $15 million and focus on their product.

- Series B: More money comes from venture capital firms. Startups worth $30 to $60 million might get $25 million.

- Series C: This is for big growth or buying other companies, with valuations of $100 to $120 million, and funding of $100 million.

- Founders’ Personal Finances – Many entrepreneurs use their savings to start their ventures.

- Family and Friends – It’s common to get financial help from close ones early on.

- Angel Investors – These investors play a vital role at the start, often investing in the idea itself.

- Crowdfunding – This lets business owners raise money from many people without giving up much ownership.

- Startup Accelerators – These programs provide money and guidance to new startups.

- Limited Operational Data – Startups at this stage base much on the founders’ vision due to lack of data.

- Focus on Product Development – Efforts are mainly on developing a product that the market will want.

- Small Investment Amounts – Money for this stage ranges from $150,000 to $1 million, which is less than later stages.

- Equity Dilution – Founders often give up 10% to 20% of their business for funding.

- Six-Month Runway – The goal is to get enough funding to last at least six months.

- Product Development: Making prototypes and improving products to fit what people want.

- Market Research: Figuring out who will buy and if the idea will work.

- Team Hiring: Bringing in people essential for the business to succeed.

- Angel Investors: People who use their own money and offer guidance.

- Venture Capitalists: Firms that invest in early companies, wanting equity and growth.

- Seed Funds: Groups that focus on investing in startups’ seed rounds.

- Friends and Family: Loved ones who can provide starting money.

- Enhancing product development

- Expanding customer acquisition efforts

- Building essential business infrastructure

- Scaling operations: Growing the team for more demand.

- Product development: Improving or creating new products.

- Market expansion: Entering new markets for brand growth.

- Marketing efforts: Increasing marketing to get more users.

- Market trends and conditions

- Financial health and revenue projections

- Startup’s potential for growth and expansion

- Expanding into new areas

- Creating new products

- Making acquisitions to stay ahead

- Market Size: A big market potential leads to higher valuations.

- Revenue Generation: Startups making money already tend to get better valuations.

- Competitive Positioning: Having a unique offer can really boost valuations.

- Management Team: A capable team with the right experience attracts higher valuations.

- Investor Sentiment: Good vibes in the market usually lead to higher valuations.

- Interest Rates: Low interest rates push investment up, boosting valuations.

- Overall Economic Stability: A steady economy means healthier investment rounds and better valuations.

Startups show their growth and enter the market through these funding rounds. This process makes funding rounds clear. It also highlights how important funding is for a startup’s success path.

Pre-Seed Funding: The First Step

Understanding pre-seed funding is vital for any new entrepreneur. It’s the start-up’s first cash infusion, turning ideas into businesses. Knowing the pre-seed funding sources helps in finding early support.

Sources of Pre-Seed Funding

Here are some key sources for initial funding:

Characteristics of Pre-Seed Stage

The characteristics of pre-seed funding highlight early challenges and chances:

Starting with pre-seed funding can be hard due to many rejections. But, with good planning and knowing where to get money, you can raise your chances of success.

Seed Funding: Turning Ideas into Reality

Seed funding is crucial for new startups. It offers the money needed to bring fresh ideas to life. At this early financing stage, entrepreneurs can pay for big costs tied to their projects. Knowing how to use this funding is key for growth.

What Seed Funding Covers

Seed funding mainly goes to:

This funding plays a big part in creating a strong base for the startup, with amounts from $500,000 to $2,000,000. It prepares the startup for more funding opportunities ahead.

Key Investors in Seed Funding

There are several key investors in seed funding. They are vital for startups at this stage. Common investors include:

These investors take big risks, hoping for large returns if the startup does well.

Series A Funding: Scaling Your Startup

Getting Series A funding is key for startups that want to grow. At this stage, it’s important to have a solid business plan, show your growth, and explain how the money will help you in the market. Knowing what you want from Series A funding can really help your business grow.

Goal of Series A Funding

Series A funding helps startups grow quickly. Investors want to see a strong business plan and potential for big growth. It’s critical to have a clear plan for how you’ll use the money. Goals often include:

Average Amount Raised in Series A

Startups usually raise between $2 million and $15 million in Series A funding. But, the average amount has gone up to about $18 million recently. This shows investors are eager to back startups with great potential. This trend means entrepreneurs are looking for more money to grow.

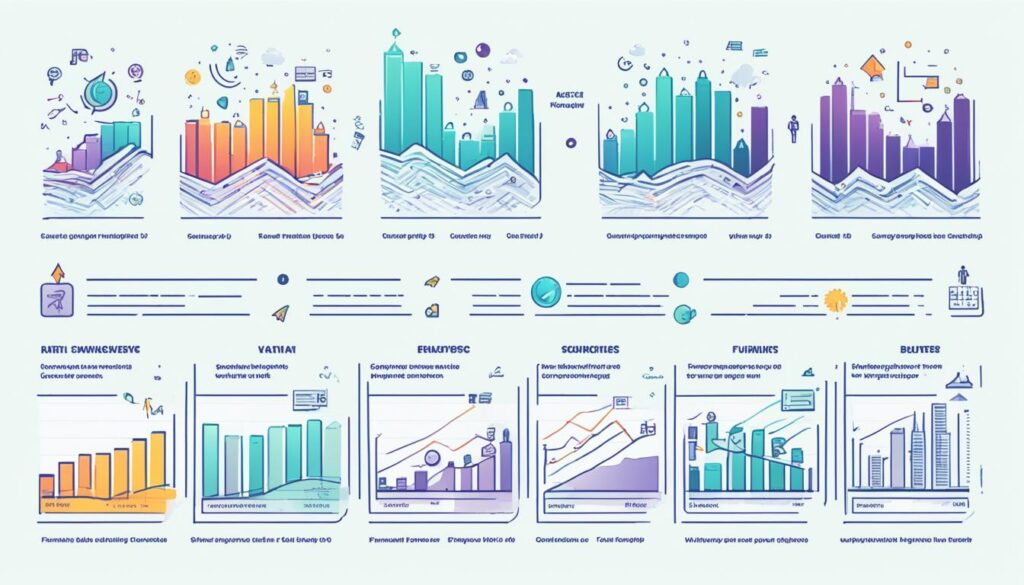

| Year | Median Series A Funding ($) | Typical Funding Range ($) | Average Funding Size ($) |

|---|---|---|---|

| 2020 | 10 million | 2 million – 15 million | 18 million |

| 2021 | 12 million | 2 million – 15 million | 20 million |

| 2022 | 14 million | 2 million – 18 million | 22 million |

Series B Funding: Getting to the Next Level

Startups often need Series B funding as they grow. It’s vital for those ready to grow their market and operations. Defining Series B funding’s purpose is key for growth finance that leads to success.

What Series B Funding is Used For

Series B funding is mainly used in different ways:

Getting Series B funding helps startups become stronger for more funding rounds. Planning how to use this money is key. Showing investors how you’ll use funds boosts their confidence.

Typical Valuations for Series B Startups

Series B valuations are usually between $35 million and $51 million. The startup valuation metrics show a startup’s market presence and validated models. Valuations are based on these things:

Understanding Series B valuations helps startups know their worth and set realistic goals.

| Funding Type | Average Amount Raised | Typical Valuation |

|---|---|---|

| Series A | $18 million | $15 million – $25 million |

| Series B | $35 million | $35 million – $51 million |

| Series C | $50 million | $100 million+ |

This table shows the average funds raised and valuations at each funding stage for startups. It highlights how Series B helps in strategic growth.

Series C Funding: Expanding & Competing

The Series C funding round is crucial for startups showing big growth. It’s meant to scale businesses that are already doing well. Getting to this phase is a big deal since only one in ten startups make it here.

At this point, big investors come into play. This includes venture capital firms and private equity companies, not small investors. For instance, JD.com set a record in 2011 by raising over $1.5 billion in Series C funding.

Startups going for Series C funding must show they’re growing fast. They need to have a strong business plan and fit well in the market. Venture capitalists look at the startup’s team and its market potential.

Series C financing is mostly used for:

Startups must be worth about $118 million to get Series C funding. This stage sets them up for future success. It could lead to them being bought or going public.

Big names like Google Ventures and Sequoia Capital are involved in Series C rounds. They invest in companies with great potential.

| Key Characteristics | Details |

|---|---|

| Typical Investors | Venture capital firms, private equity firms, hedge funds |

| Average Funding Amount | Varies widely; notable round was $1.5 billion by JD.com |

| Startup Requirements | Established customer base, revenue growth, high valuation |

| Primary Objectives | Market expansion, product development, acquisitions |

Understanding Valuations in Each Funding Round

Startup valuations change a lot depending on the funding stage. They reflect many factors. These elements shape how investors see a startup’s potential. It affects how much money they might offer. Knowing these factors is key when dealing with startup financing.

Factors Affecting Startup Valuations

Several factors play a role in startup valuations during various funding rounds:

The timing and growth path of your startup also affect its valuation. For instance, in early 2019, seed deals were valued at $8 million. Series A rounds had pre-money valuations of about $20 million. Understanding these figures helps you know what to expect when talking to investors.

The Role of Market Conditions

Market conditions are crucial in setting startup valuations. The economy plays a big part in how much funding a startup might get.

Market changes cause funding rounds to vary. The time between rounds is about 16 months on average. The amount of funding usually grows a lot, often by 5x from the last round. Knowing about market conditions is important for startup valuations.

Investor Types Across Funding Rounds

Understanding the different types of investors in startup funding is key for entrepreneurs. Each investor type offers a different mix of support, money, and advice. Knowing who they are can help you pitch better and get the funds you need.

The Role of Venture Capitalists

Venture capitalists are vital in the startup world. They invest in startups that are growing fast. They offer a lot of money for a share of the company. They also give advice that helps startups grow and compete. Firms like Sequoia Capital and Google Ventures are leaders in this space.

Angel Investors vs. Institutional Funds

Angel investors are wealthy people who fund startups early on, usually with less money than big funds. The kind of investor you go to can really affect how you plan your funding. Angels help small startups. Big funds like private equity or venture capital firms fund more established companies. Each investor type has its own expectations and rules:

| Investor Type | Funding Range | Typical Stage of Investment |

|---|---|---|

| Angel Investors | $25,000 – $1 million | Pre-seed to Seed |

| Venture Capitalists | $1 million – $250 million | Seed to Series C |

| Institutional Funds | $5 million+ | Growth Stage |

Knowing the different kinds of investors, like venture capitalists and angel investors, helps you find the right funding. This understanding lets you target your efforts to the best investors for your goals.

Challenges and Pitfalls in Startup Fundraising

In the startup world, getting money for your business is tough. A big mistake is asking for too much too soon. This can scare off investors and slow down your startup’s growth.

Founders often misjudge how much money they need. They don’t always get how investors decide to give money. This can lead to giving up more of the company than planned. It can also create unrealistic hopes.

Not getting money quickly can hurt more than just finances. It can stress founders out. Also, thinking more money will fix everything is a mistake. Good fundraising needs a plan. It should understand different stages, from the very beginning to later rounds like Series C.

| Funding Stage | Investment Range | Key Focus |

|---|---|---|

| Pre-Seed | $500K to $2M | Product development and market research |

| Seed | Up to $3M | Market testing, team hiring, and production |

| Series A | Starting at $3M | Proven business models and scaling |

| Series B | $10M and higher | Market expansion and team growth |

| Series C | Exceeding $100M | Strategic expansion and scaling operations |

Winning in fundraising means making great presentations. It’s about showing off your business plan and products in a simple way. Meeting investors at events matters too. This approach avoids many common mistakes and helps get the needed cash.

Conclusion

Knowing how startup funding works is key to getting the cash your business needs. There are different stages, from pre-seed to Series C. Each one has its own challenges and chances. This knowledge lets you make strategies to grow your business right.

The biotech world changes fast. Knowing how to get funding can really help your startup. Startups do well when they understand what each funding stage involves. It’s important to be good at making deals and hitting goals. This way, you can draw in investors ready to put a lot of money into your business.

With the right use of funding, your startup can grow strong and last long. Understanding funding helps you make smart moves. This way, your startup can become a big name in the industry.