Revealing financial insights is crucial for your success. Begin by grasping key financial statements like the income statement and cash-flow statement. These tools display your business’s performance and allow you to monitor revenue and expenses. Consistent analysis of these statements identifies trends and growth opportunities. It is important to accurately classify your assets and liabilities as this clarity facilitates better investment decisions. Moreover, strong business planning improves your decision-making and attracts investors. Through the implementation of effective financial strategies, you can boost profitability and resilience. Continue to explore to discover more strategies that can enhance your financial performance.

Key Takeaways

- Regularly analyze financial statements to identify trends and make informed decisions for business growth.

- Monitor cash flow to ensure liquidity and effectively manage operational obligations.

- Classify assets and liabilities accurately to assess financial health and investment potential.

- Establish a clear business plan with defined goals to guide resource allocation and attract investors.

Understanding Financial Statements

Understanding financial statements is essential for evaluating your business's performance and making informed decisions. These documents provide a clear snapshot of your financial health, helping you identify trends, strengths, and weaknesses.

The three primary financial statements—income statement, cash-flow statement, and balance sheet—each serve unique purposes.

The income statement reveals your revenue and expenses over a specific period, while the cash-flow statement tracks cash inflows and outflows, ensuring you meet obligations.

The balance sheet summarizes your assets, liabilities, and equity at a given point, giving insight into your overall financial position.

Analyzing the Income Statement

Regularly analyzing the income statement helps you pinpoint trends in revenue and expenses, enabling better financial decision-making. By breaking down key components, you can gain deeper insights into your business's performance.

Focus on these critical areas:

- Income: Evaluate total revenue generated from all activities.

- Cost of Goods: Assess direct expenses related to product sales.

- Gross Profit Margin: Calculate revenue minus cost of goods to understand profitability.

Exploring Cash-Flow Statements

Cash-flow statements play an essential role in tracking the money flowing in and out of your business, helping you manage your financial obligations effectively.

By detailing cash sales, receivables, and other income, you gain a clear picture of your total income. It's important to monitor total expenses as well, which encompass operational and capital-related costs.

This statement allows you to identify periods of surplus or shortfall, enabling timely adjustments. Regularly reviewing your cash-flow statement keeps you informed about your liquidity and helps you make informed decisions about investments and expenditures.

Ultimately, understanding your cash flow is fundamental for sustaining operations and ensuring your business thrives in a competitive landscape.

Classifying Assets and Liabilities

Classifying assets and liabilities accurately is essential for evaluating your business's financial health and making informed decisions about future investments. Understanding these classifications helps you maintain clarity in your financial statements.

Here's what to keep in mind:

- Current Assets: Cash, accounts receivable, and inventory.

- Long-term Assets: Property, equipment, and investments lasting over a year.

- Current Liabilities: Debts due within a year, like accounts payable.

Evaluating Owners Equity

Evaluating owners equity is essential for understanding your stake in the business and evaluating its financial health.

It's calculated by subtracting total liabilities from total assets, giving you a clear picture of your investment's worth. A positive owners equity indicates that your assets exceed your liabilities, which is a good sign for potential investors and lenders.

Regularly reviewing this figure helps you identify trends in your business's growth and stability. Additionally, monitoring changes in owners equity can reveal how effectively you're reinvesting profits back into the business.

Importance of Business Planning

Understanding owners equity sets the stage for recognizing the importance of business planning in driving sustainable growth and financial success.

Effective business planning helps you navigate challenges and seize opportunities. Here are key reasons why it matters:

- Defines your vision and goals: Clear objectives guide your efforts and resources.

- Enhances decision-making: A structured plan provides data for informed choices.

- Attracts investors: Thorough plans showcase your business's potential.

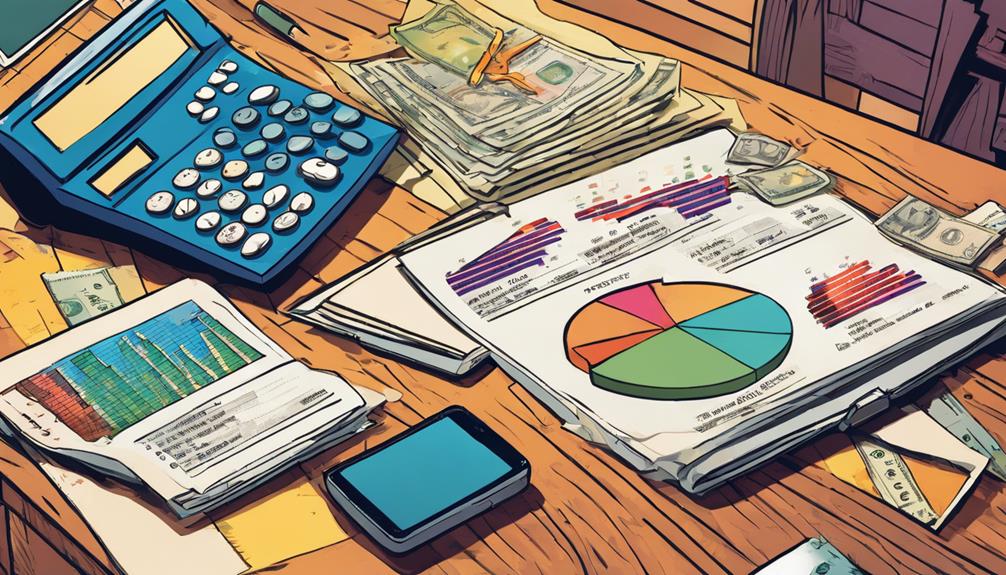

Strategies for Financial Success

Implementing effective financial strategies can greatly boost your business's growth and profitability.

Start by regularly analyzing your financial statements—income, cash flow, and balance sheets—to identify trends and areas for improvement.

Set clear financial goals and create a budget that aligns with these objectives.

Monitor your cash flow closely; make sure you maintain enough liquidity to meet obligations and seize opportunities.

Diversifying your revenue streams can also mitigate risks and enhance stability.

Don't overlook the importance of investing in technology that automates financial processes, saving you time and reducing errors.

Frequently Asked Questions

How Often Should Financial Statements Be Reviewed for Accuracy?

You should review your financial statements regularly—monthly for the income statement and cash-flow statement, and annually for the balance sheet. Consistent checks help you catch errors and maintain accurate records for better decision-making.

What Are Common Mistakes in Financial Statement Preparation?

When preparing financial statements, avoid common pitfalls like miscalculating revenue, neglecting expenses, or overlooking details. Mistakes can skew your insights, leading to poor decisions that echo through your business like shadows in a fog.

How Do Tax Obligations Affect Financial Statements?

Tax obligations impact your financial statements by reducing net profit on the income statement and affecting cash flow. Accurate tax reporting guarantees compliance, while also influencing investment decisions and overall business financial health.

What Tools Can Help Automate Financial Statement Generation?

To automate financial statement generation, you can use accounting software like QuickBooks or Xero. These tools streamline data entry, generate reports quickly, and help you maintain accurate financial records without manual effort.

How Can Small Businesses Improve Cash Flow Management?

To improve cash flow management, monitor your cash sales and receivables closely. Cut unnecessary expenses, negotiate better payment terms with suppliers, and regularly review your financial statements to identify trends and opportunities for improvement.

How Can Innovative Ideas in Financial Services Lead to Unlocking Financial Insights for Success?

Innovative financial services ideas have the power to unlock valuable financial insights for success. By introducing fresh approaches to banking, investing, and wealth management, financial institutions can tap into new opportunities and better serve their clients. These innovative ideas pave the way for more informed decision-making and improved financial outcomes.

Conclusion

In summary, grasping financial insights is like having a compass that guides your business through uncharted waters.

By understanding your financial statements and their components, you're not just crunching numbers—you're revealing the potential for growth and stability.

With these insights, you can make smarter decisions and adapt to changes with confidence.

So, embrace these tools, and watch as they pave the way for your success and sustainability in the ever-evolving business landscape.