In 2022, the French startup ecosystem was thriving, with a total investment of €11.9 billion. On average, each of the 358 startups received approximately €33 million, showcasing France as a promising hub for new businesses and investors. For individuals looking to start a business, it is essential to understand the intricacies of fundraising in France. This knowledge is key to securing funding and exploring the various methods to fund a startup in the country.

This guide will help you find out about the different ways to get funding in France. You’ll learn about public grants, private investments, and company laws. We’ll show you how to successfully get the funds your startup needs. With our help, you can make your startup successful in the competitive French market. Key Takeaways

- France raised €11.9 billion in startup funding in 2022, highlighting its vibrant ecosystem.

- Understanding various funding sources, including equity, debt, and grants, is crucial for new ventures.

- Successful fundraising requires careful planning and evaluation of your startup’s growth stage.

- Key sectors for investment, such as Fintech and Artificial Intelligence, present ample opportunities.

- Engaging with the right funding sources can shape the trajectory of your startup.

Understanding the Startup Ecosystem in France

The French startup ecosystem has changed a lot recently. It’s now full of innovation and support for entrepreneurs. They have access to resources like incubators, accelerators, and many funding options. This makes France a great place for starting a business, drawing attention from investors worldwide.

Overview of the French Startup Landscape

In 2022, France has about 25,000 startups. These companies created 1.1 million jobs and achieved a milestone with 30 tech unicorns. Originally, the goal was 25 by 2025. The value of this ecosystem was $89 billion in 2021, showing strong investor interest. BPI France played a big part by financing over 15,700 new businesses, with a total of €67 billion in 2021.

Key Sectors for Investment in France

France offers diverse investment sectors, especially in technology and services. Key areas to watch are:

- Software Development

- Fintech

- Life Sciences

- Digital Health

- Deep Tech, including AI and quantum technologies

French fintech companies raised €828.2 million in 2020. It shows the country’s strong sector, with startups like Doctolib and Charles.co. These companies underline the huge funding opportunities in digital health. Knowing about these sectors can help entrepreneurs find their way in France’s dynamic startup scene.

Defining Your Project and Location

Starting a successful startup means knowing your project and its setting well. First, you should clearly define what your business wants to achieve. This could be to grow your product range, boost market share, or improve customer loyalty. Having clear goals will guide your decisions on this journey.

Identifying Your Business Objectives

Setting business goals is key to keep your focus and guide your plan. Think about:

- Financial Goals: Set clear targets for your earnings, profit margins, and growth.

- Customer Goals: Decide how many customers you want to attract and the satisfaction level to reach.

- Operational Efficiency: Look for ways to make your processes smoother to increase output.

These goals should match your long-term vision. Studying the market well can help understand what customers need and what’s happening in your industry.

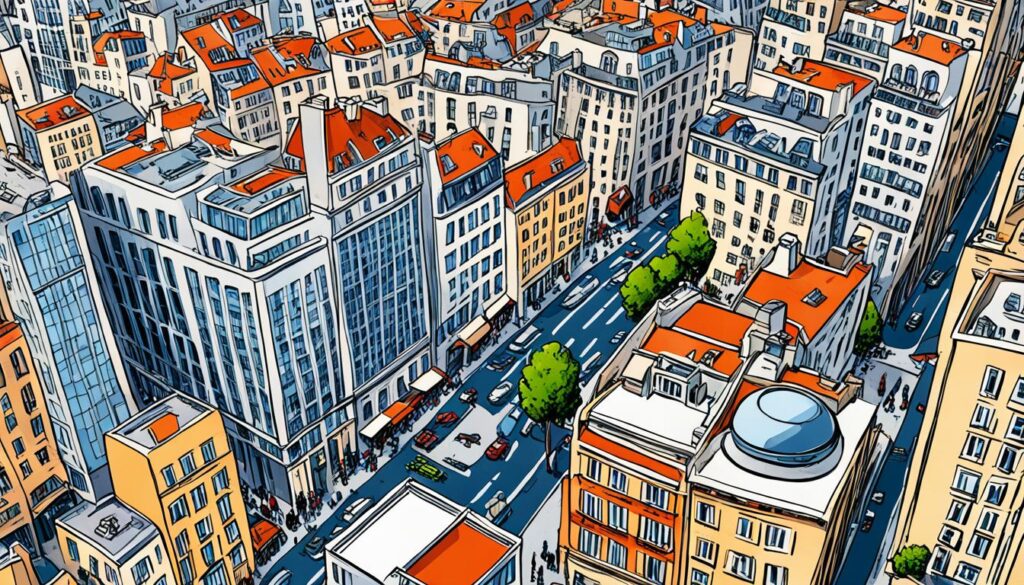

Choosing the Right Business Environment

Where you decide to locate your business in France is crucial. The decision is influenced by several factors, like:

- Customer Demographics: Knowing where your target customers live helps pick areas to best reach them.

- Available Talent: Look for places with skilled workers who can help grow your business.

- Infrastructure: Check the transportation, communication, and other essential services of potential locations.

Tools for assessing these factors can give insights into which regions match your business goals best. A careful evaluation ensures your market entry strategy works well with your business aims.

How to Get Startup Funding in France

Getting funding for your startup in France means looking at both public and private sources. Each type has its own benefits. Knowing about these sources can really help you get the money you need.

Public Funding Options

Public money in France is there to boost innovation and help startups grow. The government offers help like grants, loans without interest, and tax breaks. The French Tech initiative is one such program.

Here are some specific public funding sources:

- Grants from local and national government agencies.

- Tax incentives for startups doing research and development.

- Loans that don’t charge interest to help create jobs and support new ideas.

These public sources are key for new businesses, especially in fields like AI, biotech, and clean tech.

Private Sector Funding Sources

Private sources, like venture capital and angel investors, also play a big part. In 2022, there were more than 500 deals made, reaching almost €10 billion in total investments. Here’s how they break down:

| Investor Type | Investment Range |

|---|---|

| Angel Investors | €50,000 – €500,000 |

| Early-Stage Venture Capital | €50,000 – €2 million |

| Growth-Stage Venture Capital | €5 million – €50 million |

Startup crowdfunding is also popular in France, with 13 platforms available. These platforms let people invest in startups in different ways. Companies like Building Kingdom and UFANDAO offer unique investment options.

When you look into these options, do your homework on each one. Knowing their track record and understanding the risks is crucial. Diversifying your funding sources can also help reduce risks and boost your growth chances in France’s vibrant startup scene.

Choosing the Right Company Structure

Choosing the right company structure in France is key for success and following the rules. If you’re investing from abroad, it’s important to understand France’s investment options and legal formats. The structure you pick impacts things like taxes and how the business is run. Let’s explore your options for the best legal setup for your company.

Options for Foreign Investors

France offers a variety of legal structures for foreign business owners:

- Micro-Entreprise: Great for freelancers and solo entrepreneurs, this option simplifies things with no need for VAT registration.

- EURL (Single Person Limited Liability Company): This lets one individual fully own the company, with benefits like flexible tax options.

- SASU (Single Person Simplified Joint-Stock Company): Ideal for sole shareholders, this requires only 1 euro to start, and you can bring in more shareholders later.

- Entrepreneur Individuel (EIRL): This choice makes taxes easier and protects your personal assets against business debts.

- SARL (Limited Liability Company): A good fit for small to medium businesses, it allows different kinds of contributions and protects from liabilities.

Legal Forms to Consider

Knowing about the available legal forms helps with planning your business well:

| Legal Form | Ownership | Minimum Capital Required | Liability Protection |

|---|---|---|---|

| Micro-Entreprise | Individual | None | No |

| EURL | Single owner | Minimal | Yes |

| SASU | Single shareholder | 1 euro | Yes |

| EIRL | Individual | None | Yes |

| SARL | Multiple owners | No minimum | Yes |

It’s crucial to compare French legal forms with your business goals. Talking to local legal experts can help a lot. They’ll help you understand the French business world better.

Finding Business Premises in France

Finding the perfect business spot in France is key to your venture’s triumph. You can pick from many locations to meet your needs. The right spot boosts your visibility and helps your business run smoothly.

Types of Business Properties Available

There are different types of commercial properties in France to fit what you do. Here are the most common types:

- Offices: Perfect for businesses needing space for their administrative work.

- Warehouses: Great for companies dealing with storage and shipping.

- Retail Shops: Ideal for those wanting to sell directly to customers.

- Co-working Spaces: Good for startups and freelancers needing short-term space.

- Virtual Offices: Affordable options providing a professional address with no office space.

Temporary vs. Permanent Solutions

Choosing between temporary and permanent business spaces has its pros and cons. Temporary options like co-working spaces offer flexibility and lower costs upfront. They are great for new businesses trying to understand the market. You can change your space based on what your business needs.

Permanent spots, like buying or leasing a space, offer more stability and can make your brand look better. But, buying a place costs more than renting one.

Opening a Business Bank Account

Starting a business bank account in France is crucial for new entrepreneurs. It helps manage finances and meets banking needs. Different banks might have their own rules.

Required Documentation and Process

To open your account, you’ll need certain documents. these include:

- Your identification, like a passport or national ID

- A business plan with details on suppliers, employees, and sales forecasts

- Proof of a business address, for example, a lease document

- A financial statement showing your startup money

Even though the law says you can open an account with just one euro, banks usually suggest starting with 4,000 euros. This covers initial costs and shows you’re serious. After handing in your paperwork, a meeting with bank reps comes next. Speaking French is very helpful for this, though some bank employees might speak English.

Banks want to know your business can succeed. They often prefer businesses in areas like retail or e-commerce, which cost less to run. It’s key to be honest about where your funding comes from. This is because banks are very strict about preventing money laundering.

Registering Your Company in France

Starting a business in France takes careful planning, especially with the company registration in France steps. Getting a SIRET number is a must for legal and tax reasons. It makes sure your business follows French law.

Understanding the SIRET Number

A SIRET number has 14 digits and identifies your company and location. Every business in France needs this number. It helps with billing and taxes, making sure you meet local laws. Without it, you can’t legally do business in France. Make sure to get this number when you register your company.

The Registration Process

Registering your company in France means following several important steps. These steps help make sure your business meets French laws. Here’s what you need to do:

- Choose your business type: You can start a liaison office, branch, or subsidiary.

- Collect all needed documents: You’ll need ID, proof of address, and more.

- Sign up with the right authorities: The Centre de Formalités des Entreprises (CFE) is in charge of registration.

- Get your SIRET number: You’ll get this soon after your registration is approved.

- Sign up for VAT if you need to: If you make over 35,000 euros a year, you must register for VAT.

It usually takes about two weeks for local businesses to complete this process. Remember, following these steps carefully ensures your business is set up right in France.

| Business Structure | Minimum Share Capital | Requirements |

|---|---|---|

| Limited Liability Company (SARL) | €1 | 1 shareholder minimum |

| Simplified Joint-Stock Company (SAS) | €37,000 | 1 shareholder minimum |

| Joint-Stock Company (SA) | €37,000 | 7 members minimum |

| Branch Office | N/A | Specific local requirements |

| Sole Proprietorship | N/A | No formal capital required |

Hiring Staff and Understanding Labor Laws

Running a successful business in France requires knowing local labor laws well. Hiring staff means you must follow strict rules to protect workers’ rights. This guide will help you understand the hiring process and important rules for employers.

Recruitment Process Explained

To start hiring in France, write a detailed job description first. It should list the job’s main duties, necessary qualifications, and pay. There are critical points employers need to be mindful of:

- Job ads cannot contain discriminatory language.

- When screening candidates, respect their privacy as per GDPR rules.

- Getting references requires the candidate’s okay.

A well-planned recruitment includes these steps:

- List the must-have skills and qualifications for the job.

- Share the job opening widely but follow labor laws closely.

- Interview candidates fairly, focusing on equality.

- Offer the job officially, being sure to follow contract laws.

Employee Contracts and Regulations

Understanding labor laws is key to creating employee contracts. The contract needs to follow rules like:

- The longest probation for full-time jobs is eight months.

- Employees are entitled to paid vacation and retirement benefits.

- The French Labor Code bans any form of discrimination.

Employers also need to consider:

| Regulation | Details |

|---|---|

| Minimum Wage | €1,766.92 monthly or €11.65 per hour for full-time work. |

| Overtime Rules | Extra hours are capped at 48 a week, with higher pay for overtime. |

| Non-compliance Penalties | Wrongly categorizing employees can lead to €250,000 in fines. |

Following labor laws and creating clear contracts helps your business run smoothly. It also keeps employees happy and meets legal standards.

Conclusion

Getting money for your startup in France takes a lot of work. You need to plan well, know your resources, and move strategically. This guide has covered key parts like public funds, equity fundraising, and connecting with investors. Using different funding ways can help your startup do well and deal with France’s startup challenges.

Finding funds is competitive, with options like BPI France grants and help from Business Angels or firms like Inco and Phitrust. It’s crucial to prepare well and make a solid business plan, often called “the Deck.” This can open doors to funding from €30,000 to big seed funding amounts.

Starting your business in France means learning many details to succeed. It also means grabbing chances that match your new ideas. Follow this detailed guide to grow a successful startup in France’s active market.