To build wealth through real estate, consider starting by investing in rental properties to generate a consistent cash flow. Look for areas with strong potential for appreciation and explore diversifying into commercial real estate for higher profits. House flipping is another attractive option, involving purchasing, renovating, and selling properties for a profit. Additionally, investing in Real Estate Investment Trusts (REITs) provides access to diversified real estate portfolios with a lower initial investment. Remember to keep learning and networking to refine your strategies. The world of real estate entrepreneurship has much more to offer, so keep exploring!

Key Takeaways

- Focus on cash flow by investing in rental properties to generate steady income and cover expenses.

- Leverage real estate appreciation by choosing properties in desirable locations and maintaining them well for long-term value growth.

- Explore commercial real estate for potentially higher returns and longer lease terms, enhancing cash flow stability.

- Consider investing in REITs for diversified real estate exposure without the need for large capital investments.

Benefits of Rental Properties

Investing in rental properties offers you a steady cash flow and the potential for long-term financial growth. By renting out your property, you receive monthly payments from tenants, which can greatly boost your income.

For example, a property purchased for $200,000 and rented at $1,500 a month can yield an impressive $18,000 annually. This consistent cash flow allows you to cover mortgage payments, property taxes, and maintenance costs while still generating profit.

Furthermore, the demand for rental housing remains strong, ensuring your investment stays profitable over time. With careful management and strategic location choices, your rental properties can provide you with financial security and pave the way for future investments, maximizing your wealth-building potential.

Understanding Real Estate Appreciation

Real estate appreciation is a crucial factor that can greatly boost your investment's value over time, making it essential to understand how it works.

Properties generally increase in value due to various factors, including economic growth, location, and demand. By grasping these elements, you can make informed decisions that enhance your investment's potential.

- Economic indicators, like job growth, influence property values.

- Location is key; properties in desirable areas appreciate faster.

- Regular property maintenance contributes to value retention.

Exploring Commercial Real Estate

Understanding the dynamics of property appreciation sets a strong foundation for exploring the lucrative opportunities offered by commercial real estate (CRE).

When you immerse yourself in CRE, you're tapping into properties like shopping centers, office buildings, and warehouses, which often yield higher returns than residential investments.

With longer lease terms and higher rental rates, these assets can provide a steady cash flow.

Additionally, diversifying into CRE can mitigate risks, balancing your overall investment portfolio.

Keep an eye on market trends and economic factors that influence demand, as they can greatly affect your returns.

Investing in REITs

When you consider REITs, you gain access to a diversified portfolio of income-generating real estate without the need for direct management. This investment strategy allows you to benefit from real estate's potential returns while minimizing the hassles of property ownership.

With REITs, you can invest in various sectors, from residential to commercial properties. Here are some key advantages:

- Liquidity: Buy and sell shares like stocks.

- Diversification: Spread your investment across multiple properties.

- Passive Income: Earn dividends from rental income.

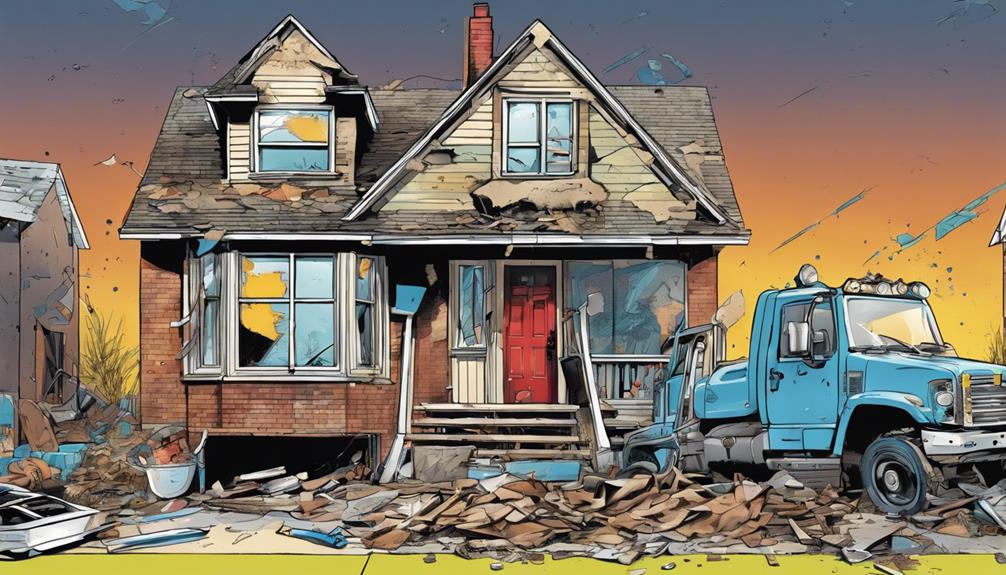

The House Flipping Strategy

Flipping houses can be a lucrative strategy, allowing you to buy, renovate, and sell properties for a profit. To succeed, you need a keen eye for potential homes and an understanding of market trends.

Start by identifying undervalued properties in desirable areas; these often yield the highest returns. Once you've purchased a property, focus on essential renovations that enhance value without overspending. Keep track of your budget and timeline to maximize profits.

After renovations, stage the home to attract buyers quickly. Remember, the average gross profit for flipped houses was around $62,300 in 2020, demonstrating the potential rewards.

With the right approach, flipping houses can be a fulfilling and profitable venture in real estate.

Young Entrepreneurs in Real Estate

Young entrepreneurs are increasingly making their mark in the real estate sector by leveraging innovative strategies and fresh perspectives. With their tech-savvy skills and a keen eye for market trends, they can tap into opportunities that previous generations might've overlooked.

Here are some key strategies to contemplate:

- Networking: Build relationships with mentors and peers to gain insights and support.

- Social Media Marketing: Utilize platforms like Instagram and TikTok to showcase properties and attract potential buyers.

- Crowdfunding: Explore crowdfunding platforms to raise capital for your real estate projects.

Small Business Opportunities in Real Estate

Numerous small business opportunities exist in real estate, allowing entrepreneurs to capitalize on diverse market needs and trends.

You can explore property management, which involves managing rental units for owners, ensuring steady income.

Consider becoming a real estate agent, where you can help buyers and sellers navigate the market while earning commissions.

Flipping houses is another lucrative option; buy, renovate, and sell for profit.

Additionally, you might investigate real estate photography or staging, enhancing property appeal to attract buyers.

If you're tech-savvy, developing real estate apps or websites can fulfill market demands.

With creativity and market insight, you can find a niche that suits your skills and passions while building a successful business in real estate.

Personal Development for Success

To achieve success in real estate and beyond, focusing on personal development is essential for honing your skills and enhancing your mindset. Investing time in your growth can lead to better decision-making, improved communication, and increased confidence.

Here are some strategies to contemplate:

- Set clear goals: Define what success looks like for you and create a plan to achieve it.

- Embrace lifelong learning: Continuously seek knowledge through books, courses, and networking.

- Cultivate a growth mindset: View challenges as opportunities and learn from failures.

Frequently Asked Questions

How Do I Finance My First Real Estate Investment?

To finance your first real estate investment, consider securing a mortgage, using personal savings, or seeking partners. You can also explore government loans or crowdfunding platforms to gather the necessary funds effectively.

What Legal Considerations Should I Be Aware of in Real Estate?

Did you know that 30% of real estate lawsuits involve landlord-tenant disputes? You should understand local laws, contracts, zoning regulations, and property disclosures to protect yourself and guarantee compliance in your investments.

How Can I Effectively Manage Rental Properties?

To effectively manage rental properties, you should screen tenants carefully, maintain the property regularly, respond promptly to issues, and keep clear records. Effective communication with tenants builds trust and guarantees a smoother management experience.

What Are the Tax Implications of Real Estate Investments?

You might think real estate investments are straightforward, but tax implications can be complex. Consider depreciation, capital gains, and 1031 exchanges. Understanding these can greatly impact your overall profitability and wealth-building strategy in real estate.

How Do Market Trends Affect Real Estate Investment Decisions?

Market trends shape your real estate investment decisions considerably. By analyzing demand, interest rates, and economic indicators, you can identify opportunities and risks, ensuring your investments align with current market conditions for ideal returns.

Conclusion

As you step into the world of real estate, remember this: every property holds potential, every strategy is a stepping stone.

Whether you're renting, flipping, or investing in REITs, each choice can lead to newfound wealth.

Embrace the journey, learn from every experience, and watch your aspirations unfold.

With determination and strategy, you can transform your financial future—so why wait?

Immerse yourself, seize the opportunities, and let your real estate adventure begin!