To become proficient in real estate tactics, you must explore techniques such as house hacking, which involves reducing your mortgage by renting out a portion of your property. The BRRRR method involves buying, renovating, and refinancing to expand your portfolio. Wholesaling allows you to acquire distressed properties at a lower cost, while flipping homes allows for fast profits through renovation and resale. Real estate syndications allow you to combine resources for bigger investments. Each strategy comes with its own set of risks, but understanding them can boost your chances of success. There is still much to learn about these methods.

Key Takeaways

- Explore house hacking to reduce mortgage costs while gaining landlord experience and generating rental income.

- Utilize the BRRRR method to buy undervalued properties, renovate, and refinance for capital to invest further.

- Engage in wholesaling by identifying distressed properties and negotiating contracts for profitable assignments to buyers.

- Consider flipping properties for profit by purchasing undervalued homes, managing renovations, and selling at market highs.

House Hacking Explained

House hacking lets you buy a property, live in part of it, and rent out the rest to reduce your monthly mortgage payments. This strategy works particularly well with duplexes or multiplexes, where you can create separate living spaces for tenants.

As a new landlord, you'll gain valuable experience while enjoying lower living costs. You'll also qualify for residential mortgages as an owner-occupant, making it easier to secure financing.

Understanding the BRRRR Method

The BRRRR method, which stands for Buy, Rehab, Rent, Refinance, and Repeat, is a powerful strategy that allows you to build wealth through real estate investments.

First, you'll buy properties below market value, setting yourself up for potential gains.

Then, focus on rehabbing the property to increase its value, which positively impacts your appraisal.

Once the renovations are complete, rent it out to cover your mortgage costs and generate cash flow.

After stabilizing your rental income, refinance to pull out your invested capital, enabling you to invest in additional properties.

By repeating this cycle, you can rapidly grow your real estate portfolio while minimizing your initial cash outlay.

This method can greatly amplify your wealth-building potential in real estate.

Wholesaling and Driving for Dollars

Wholesaling and driving for dollars offer investors a unique way to profit from undervalued properties without the need for significant capital.

You'll start by identifying distressed properties in your area, often by driving through neighborhoods and looking for signs of neglect.

Once you find a potential deal, research the property's value and reach out to the owner to negotiate a purchase contract. Your goal is to secure the property at a low price and then assign the contract to a buyer for a fee.

Success in wholesaling hinges on your ability to spot opportunities and negotiate effectively.

Flipping Properties for Profit

Flipping properties for profit involves quickly buying undervalued homes, renovating them, and selling for a higher price to capitalize on market demand. This strategy requires you to identify the right properties and work efficiently to maximize your returns. Here's a quick overview of key factors and potential costs involved in flipping:

| Factor | Considerations |

|---|---|

| Purchase Price | Below market value |

| Renovation Costs | Budget effectively |

| Selling Price | Aim for market highs |

| Timeframe | Complete within months |

Exploring Real Estate Syndications

Real estate syndications offer a powerful way to pool resources with other investors, enabling you to access larger properties and diversify your investment portfolio.

By joining forces with accredited investors, you can invest in commercial properties or multifamily units that might otherwise be out of reach.

The syndicator manages the deal, handling everything from acquisition to property management, allowing you to enjoy passive income without the daily hassles of property upkeep.

There are both public and private syndication options, and crowdfunding platforms have made it easier for non-accredited investors to participate.

Before jumping in, though, make sure to carefully vet your syndication partners and understand the terms to protect your investment.

Live-In-Then-Rent Strategy

The Live-In-Then-Rent strategy lets you start your real estate journey by occupying a property before converting it into a rental, providing flexibility and a budget-friendly entry point into investing. This approach allows you to live comfortably while building equity in your home.

Once you move out, you can rent the property to generate passive income. Unlike house hacking, this strategy keeps your living space separate from tenants, appealing to those who prefer privacy.

It also minimizes upfront costs, as you can use a residential mortgage to purchase the property. As you evolve into a landlord, you'll gain valuable experience managing tenants and properties, setting you up for future investment success.

Risks and Challenges in Real Estate

Steering through the risks and challenges in real estate requires a keen understanding of market fluctuations and potential legal disputes that can impact your investments.

Here are some key risks to take into account:

- Market Volatility: Property values can fluctuate greatly, affecting your investment's worth.

- Legal Issues: Zoning laws, tenant disputes, and compliance regulations can lead to costly legal battles.

- Financing Risks: Interest rates and loan terms can change, impacting your cash flow.

- Maintenance Costs: Unexpected repairs can drain your budget and affect profitability.

Success Stories in Real Estate Investing

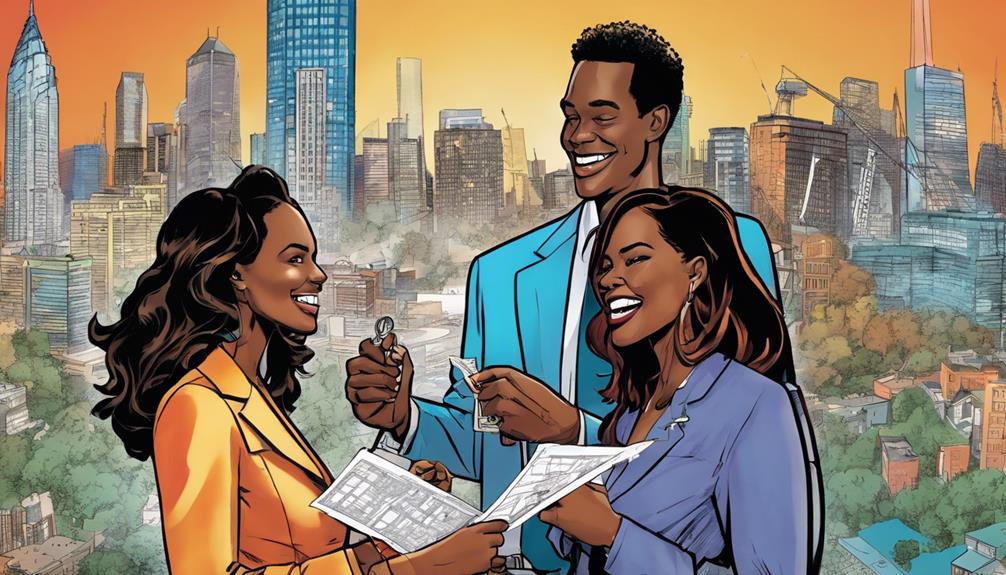

Success in real estate investing often stems from strategic decisions and learning from others' experiences.

Take, for instance, the story of a young investor who bought a duplex, lived in one unit, and rented out the other. This house hacking strategy not only reduced their mortgage but also provided valuable landlord experience.

Another investor embraced the BRRRR method, purchasing a rundown property, renovating it, and refinancing to fund their next deal.

These success stories show that with careful planning and a willingness to adapt, you can achieve significant returns.

Frequently Asked Questions

What Financing Options Are Available for First-Time Real Estate Investors?

When you're starting as a first-time real estate investor, consider options like FHA loans, conventional mortgages, or VA loans. These can help you secure financing with lower down payments and favorable terms tailored for beginners.

How Do I Determine the Best Rental Price for My Property?

Setting the right rental price is like finding the sweet spot in a recipe. Start by researching local market trends, comparing similar properties, and considering amenities, then adjust based on your property's unique features for maximum appeal.

What Are the Tax Implications of Real Estate Investing?

When you invest in real estate, you face various tax implications, including property taxes, capital gains tax on sales, and potential deductions for mortgage interest and depreciation. Understanding these helps you optimize your investment strategy effectively.

How Can I Find Reliable Contractors for Renovations?

Finding reliable contractors can feel like searching for a needle in a haystack. Start by asking for recommendations from friends, checking online reviews, and interviewing multiple candidates to guarantee you choose the right fit for your renovations.

What Are Common Mistakes to Avoid in Real Estate Investing?

When investing in real estate, avoid over-leveraging, neglecting due diligence, underestimating renovation costs, and ignoring market trends. Stay informed, budget realistically, and always analyze potential risks to guarantee a successful investment journey.

How Can Insurance Costs Impact Real Estate Investment Strategies?

When developing real estate investment strategies, it’s crucial to consider the impact of master insurance cost strategies. High insurance costs can eat into potential profits, while lower costs can improve cash flow and overall investment returns. Understanding and optimizing insurance expenses is a key aspect of successful real estate investing.

Conclusion

In the world of real estate investing, you hold the keys to access your financial future.

Whether you immerse yourself in house hacking or master the BRRRR method, each strategy opens a door to new opportunities.

Imagine walking through these doors, each leading to a brighter, more prosperous life.

Embrace the risks, learn from the challenges, and let your success story unfold.

With the right strategies in hand, you're not just investing; you're building your legacy.