Revealing the secrets to financial freedom begins with embracing your independence and understanding economic principles. It is important to reconsider your budgeting techniques, focusing on generating income rather than just saving. Instead of relying on politicians for solutions, take charge of your finances and empower yourself to instigate change. Conquer financial indifference by regularly assessing your financial situation and setting realistic goals. Overcome entitlement attitudes by acknowledging the worth of every job, and adopt a growth mindset that embraces challenges. Your path to financial empowerment is just starting, and there is much more to learn about achieving your goals successfully.

Key Takeaways

- Embrace independence by managing your finances, which builds resilience and prepares you for future stability.

- Understand economic fundamentals like supply and demand, inflation, and interest rates to enhance your financial decision-making.

- Shift your budgeting focus from saving to generating income through investments and productive spending patterns.

- Cultivate self-reliance and avoid dependency on political solutions, empowering yourself to create meaningful financial change.

The Importance of Independence

Independence is essential for your financial growth, as it empowers you to seize opportunities and make decisions that can lead to a more prosperous future.

When you live close to your parents, you might find comfort, but that can stifle your financial potential. Breaking away from familiar surroundings often nudges you toward better job prospects and personal growth.

By embracing independence, you'll cultivate a mindset that prioritizes self-sufficiency and resilience. Yes, change can be intimidating, but it often opens doors you never knew existed.

As you take charge of your finances, you'll learn to navigate challenges and build a solid foundation for your future. Remember, it's in the unknown that you'll discover your true capabilities.

Understanding Economic Fundamentals

Grasping the basics of economics is essential for making informed financial decisions that can enhance your wealth-building potential. Understanding economic fundamentals empowers you to navigate financial landscapes effectively.

Here are three key concepts to reflect upon:

- Supply and Demand: Recognizing how these forces impact prices helps you make smarter purchasing choices.

- Inflation: Understanding inflation's effect on your money's purchasing power is vital for long-term financial planning.

- Interest Rates: Knowing how interest rates influence borrowing and saving can greatly affect your financial strategies.

Rethinking Budgeting Strategies

Rethinking your budgeting strategies can open up new avenues for financial growth and empower you to focus on income generation instead of just saving.

Instead of fixating on cutting costs, consider allocating funds toward investments that can yield higher returns. Embrace a mindset that prioritizes opportunities over limitations.

Analyze your spending patterns and identify areas where you can redirect funds into income-generating activities, like side hustles or skill development. This proactive approach shifts your focus from mere survival to thriving financially.

Remember, it's not just about managing what you have; it's about expanding your financial landscape.

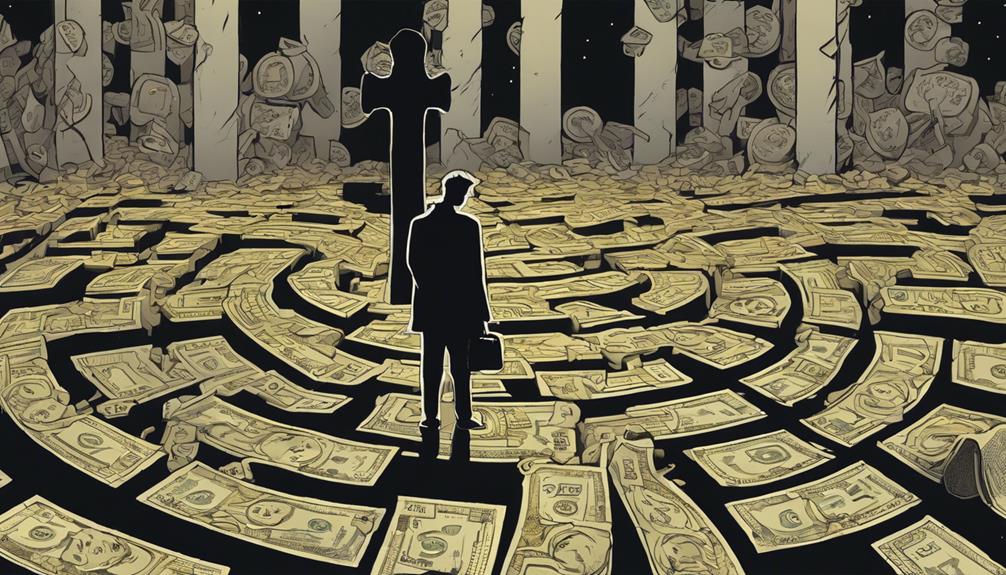

The Myth of Political Solutions

Many people mistakenly believe that politicians hold the key to solving their financial woes. This misconception can trap you in a cycle of waiting for change instead of taking proactive steps.

Here are three reasons why relying on political solutions is misguided:

- Unfulfilled Promises: Politicians often make lofty promises that rarely come to fruition, leaving you in the same financial predicament.

- Worsening Conditions: Despite political assurances, economic indicators frequently show a decline, disproportionately affecting the middle class.

- Self-Reliance is Key: True financial freedom comes from taking control of your finances rather than depending on external entities.

Combating Financial Apathy

Taking an active interest in your finances is essential for breaking free from financial apathy and fostering a path toward improvement.

Start by regularly reviewing your financial situation—take stock of your income, expenses, and savings. Set specific, achievable goals that motivate you to engage with your money.

Discuss your finances with others; sharing experiences can spark new ideas and insights. Don't ignore problems; acknowledging them is the first step toward resolution.

Consider educating yourself on economic principles to enhance your understanding and decision-making. Remember, neglecting your finances only worsens your situation.

Overcoming Entitlement Attitudes

To overcome entitlement attitudes, embrace the idea that every job, no matter how humble, can be a stepping stone to financial success. Shifting your perspective is essential for revealing opportunities.

Here are three actions you can take:

- Seek Experience: Accept positions that build your skills and expand your network, even if they're not your dream job.

- Cultivate a Strong Work Ethic: Commit to giving your best effort in every role, showing potential employers your dedication and reliability.

- Challenge Your Standards: Reevaluate what you consider acceptable work; sometimes, the path to financial freedom requires starting from the bottom.

Shifting Mindsets for Growth

Shifting your mindset from entitlement to a growth-oriented perspective opens doors to new opportunities and financial success. Instead of expecting rewards without effort, embrace challenges as stepping stones.

When you stop comparing your situation to others, you'll focus on your progress, leading to better decision-making. This shift encourages you to take on various jobs and learn new skills, enhancing your marketability.

Remember, financial growth isn't just about saving; it's about generating income through innovative strategies. Engage actively with your finances, and don't shy away from discussions that deepen your understanding.

A proactive approach empowers you, making it easier to seize opportunities and tackle obstacles head-on. Your journey to financial freedom starts with this vital mindset transformation.

Conclusion

As you stand at the crossroads of your financial journey, envision a path lined with opportunities, where self-reliance lights your way.

Embrace the tools and strategies that empower you to break free from limitations, transforming your dreams into reality.

Let go of past burdens and step boldly into a future where you control your destiny.

Remember, the keys to financial freedom are in your hands—unlock the door and step into a life of abundance and possibility.