Think about how you feel handling your business’s finances. You might have felt anxious trying to figure out complex costs. Every number has a big impact on what your company does next. Knowing about mixed costs is key for smart choices on money and growth. This guide will show you how to sort out mixed costs. This will make it simpler to look at your finances and help your business grow.

Key Takeaways

- Understanding mixed costs is crucial for effective financial management.

- Separating mixed costs helps clarify fixed and variable cost components.

- Awareness of mixed costs aids in accurate cost analysis and pricing strategies.

- Employing methods like the high-low method enhances cost management precision.

- Clear categorization fosters better decision-making within your business.

Understanding Mixed Costs

Mixed costs are key in financial management, especially for businesses planning budgets and operations. They are known as semivariable or semi-fixed costs. This means they have both fixed and variable expense parts. It’s vital to analyze them to understand a company’s cost structure well.

Definition and Characteristics

Mixed costs have both fixed and variable parts. Fixed costs stay the same, no matter the production levels. Variable costs, on the other hand, change with the quantity of goods or services made. A company’s building depreciation is fixed, whereas utility costs can vary with use.

Creating budgets needs an understanding of mixed costs. They are assessed using the formula Y = a + bx. In this, Y is the total cost, a represents the fixed cost, b is the variable cost per unit, and x is the activity level. This shows how mixed costs are complex, affecting budgeting and forecasting.

Examples of Mixed Costs

Many industries see mixed costs daily. For instance, consider a manufacturing facility’s electricity bill. It combines a fixed base charge and a variable cost for electricity used in production.

Another example is a broadband contract from a cable provider. It has a fixed monthly rate, and extra charges apply if usage exceeds a set limit. These examples help understand how mixed costs influence pricing and resource use.

| Cost Type | Fixed Component | Variable Component |

|---|---|---|

| Electricity Bill | Base charge for service | Cost per kilowatt-hour used |

| Broadband Contract | Monthly subscription fee | Additional fees for data usage |

| Building Expenses | Depreciation of property | Variable utilities and maintenance |

Understanding mixed costs and their characteristics is key for good financial planning and making smart choices. Managing mixed costs well can greatly help a company’s profits and help optimize resource use.

Why It’s Essential to Separate Mixed Costs

It’s crucial for businesses to split costs to better manage their finances. Mixed costs include fixed and variable parts, making financial reports and decisions complex. Handling these costs well brings many benefits.

Impact on Financial Reporting

For accurate financial reports, it’s important to know the different cost parts. Splitting mixed costs helps create precise financial statements. This makes it easier for stakeholders to invest, budget, and allocate resources wisely.

Benefits for Cost Management

There are big advantages to separating mixed costs. It makes budgeting and forecasting clearer, showing which costs you can control. Understanding costs better leads to improved efficiency and smarter choices about pricing, products, and using resources.

| Cost Type | Description | Example |

|---|---|---|

| Fixed Costs | Costs that remain constant regardless of activity level | Rent, salaries, insurance |

| Variable Costs | Costs that fluctuate with changes in production or sales volume | Raw materials, sales commissions |

| Mixed Costs | Costs that contain both fixed and variable components | Electricity bill for a manufacturing facility |

How to Separate Mixed Costs

Separating mixed costs into their fixed and variable parts is key for good budgeting. There are several ways to do this. The most used methods include scattergraphs, the high-low method, and regression analysis.

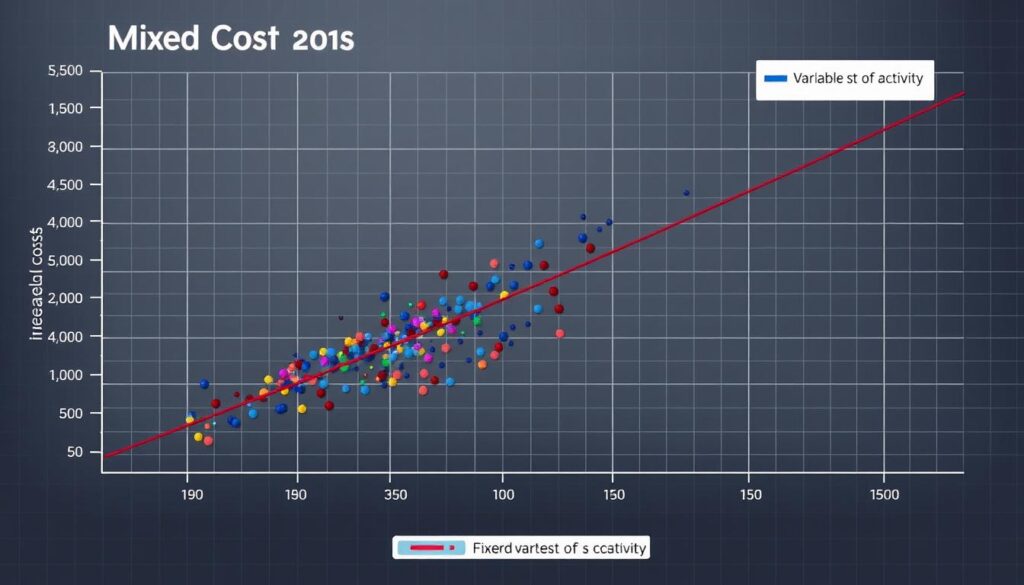

Preparing a Scattergraph

A scattergraph shows how total costs and production levels relate. By plotting total costs versus machine hours, it’s easy to see the difference between fixed and variable costs. This is because of the graph’s slope and where it crosses the y-axis.

Using the High-Low Method

The high-low method looks at the highest and lowest levels of activity. It estimates the fixed and variable parts of costs from these points. However, it’s simple but might not be very accurate because it only uses two points.

Conducting Regression Analysis

Regression analysis considers all the data points. It gives a detailed breakdown of mixed costs. This method is more precise because it looks at everything, not just the highs and lows.

It offers a way to accurately predict how costs behave as production changes. With it, you get deep insights into cost behavior.

Using these methods can really help understand and manage mixed costs. They give you the tools needed for smart business decisions.

The High-Low Method Explained

The high-low method is a way to figure out fixed and variable costs from a few data points. It simplifies cost analysis. Knowing how to use the high-low method, its benefits, and limits improves cost management.

Steps to Implement the High-Low Method

Here are the steps to start using the high-low method:

- Identify the highest and lowest activity levels: Find the data for the highest and lowest levels of activity.

- Calculate the variable cost per unit: Use the formula: Variable Cost = (Highest Activity Cost – Lowest Activity Cost) / (Highest Activity Units – Lowest Activity Units).

- Derive the fixed cost: Subtract the variable cost per unit times the highest activity units from the highest cost.

- Compile results: Combine fixed and variable costs into a model. This predicts expenses at different activity levels.

Advantages and Limitations of the Method

The high-low method is simple because it only needs two data points. It’s easy to use without complex math.

However, depending only on the highest and lowest data points can make it less accurate. Costs can change a lot between these points. This might distort cost predictions. With outliers or not enough data, the method might not work as well as more complex techniques like regression analysis.

| Factor | High-Low Method | Regression Analysis |

|---|---|---|

| Data Points Required | Two points | All available data points |

| Complexity of Calculation | Simple | More complex |

| Accuracy | Potentially less accurate | Generally more accurate |

| Speed of Analysis | Quick | Requires more time |

Understanding both the good and bad of the high-low method helps in making better business decisions. It’s useful for analyzing products or areas of operation. Using this method carefully gives important insights into how costs behave.

Using Regression Analysis for Mixed Costs

Regression analysis is a key method for accurate cost estimation. It explores the complex link between costs and activity levels. This leads to a better grasp on cost behavior in various scenarios. By looking at all data points, it finds patterns that other methods might miss.

It starts with special financial analysis tools software. This software figures out the best cost model from your data. For example, it can separate fixed and variable costs in electricity bills from equipment use. It does this by plotting total electricity costs against monthly equipment hours. The line’s slope shows the variable cost per hour.

Regression analysis has a big plus: it uses all available data for a fuller cost understanding. Unlike the high-low method, which uses just two points, regression looks at many data points. This boosts prediction accuracy. It also spots outliers that might skew your calculations, keeping your analysis accurate.

Moreover, regression analysis gives statistical insights, which includes how confident you can be in your cost estimates. Having this certainty helps companies make smart financial choices during cost changes. By using regression analysis for mixed costs, businesses gain essential insights. This helps them understand and adapt to their financial landscape better.

Conclusion

Exploring the conclusion on mixed costs shows us the value of clear separation. It boosts financial precision and helps in strategic management. Knowing about mixed costs helps you make your financial reporting better. It also upgrades your strategies for managing costs.

This knowledge helps you understand financial data better. Let’s look at the main points from this guide. We learned about different ways to separate mixed costs. These include scattergraphs, the high-low method, and regression analysis.

Each method meets specific business needs. This supports making smart financial decisions. Realizing the value of separating costs helps in creating accurate budgets. It also leads to deeper financial insights and stronger control over operations.

By using these techniques, you’ll get better at handling your organization’s budgeting and forecasting. Mastering mixed costs allows you to face challenges with confidence. With clear strategies, you can estimate costs better. This boosts your organization’s financial health.